In this week’s Dark Luxury news round-up

A subtle change to the UK’s rules to tackle money laundering could snare many smaller luxury firms

What did execs at Diageo know about Diddy’s alleged crimes?

Donald Trump triples down on plans to accept a flying palace from the Qataris

Has Alexandre Arnault been given a poisoned chalice by his father Bernard Arnault?

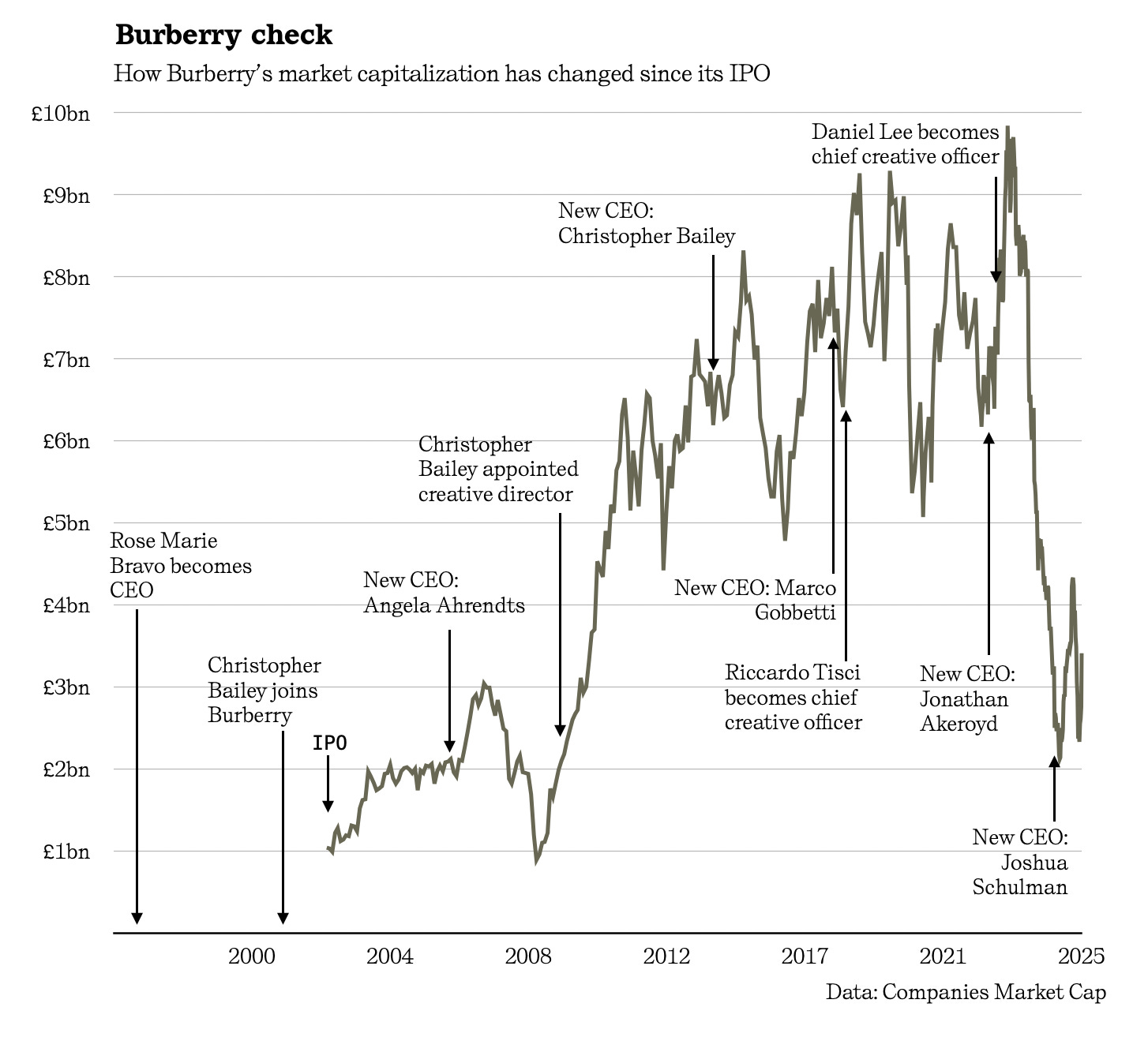

Is the Burberry revival back on track?

Burberry gets boost by saying it will cut staff

Burberry’s share price has risen by as much as 18 per cent today after it beat analyst estimates and announced it was cutting nearly a fifth of its workforce over two years, after reporting a £66 million loss in pre-tax profit in the year up to March. Last year the firm recorded a £383 million profit. CEO Joshua Schulman said the company had a “challenging first half” of its financial year, and said the global slowdown in luxury sales as well as the “macroeconomic environment” (i.e. Donald Trump’s tariffs campaign) meant that “things got pretty choppy in February”. The firm is in the early stages of what it calls the “Burberry Forward transformation programme”, which is designed to turn around a business which has struggled for years. As our chart shows, there’s still some way to go.

Three key points which we found interesting in the report:

About 150 jobs are reportedly at risk at its Castleford factory in West Yorkshire, which makes the company’s iconic trench coats. The night shift will be cut and the factory will move to one shift, which Shulman said, “is essential to safeguard the long-term viability of our UK manufacturing operations”.

Its report also mentioned that the withdrawal of VAT refunds for overseas visitors in the UK, which it said had “made the UK the least competitive destination in Europe for tourist shopping”. Expect more lobbying like this from the UK’s luxury retailers.

Wholesale revenue declined 37 per cent to £319 million as the firm conducts a “strategic review of our partners”, and as a result of “a challenging consumer demand environment”. Dark Luxury readers will know that the wholesale market is traditionally one of the main channels by which daigou and other grey market traders access cheaper luxury goods. (Investegate)

Further encouraging news for investors was the rejection of Burberry’s failed ‘brand elevation’ strategy which meant prices increased in line with French and Italian luxury counterparts. The brand will also move its design and marketing from “modern British style” to “timeless British style” which was also what our experts recommended in the piece, “Why Burberry should be Bourgeois”.

Crisis at Moët Hennessy

The Financial Times’ scoop based on previously unseen documents about the problems at Moët Hennessy really hammers home how Alexandre Arnault has been given a poisoned chalice by his father Bernard Arnault. Now the deputy CEO, Arnault Jr is responsible for addressing the bad and slow executive decisions at LVMH’s drinks business in recent years, and he has few options to turn things around. “One source said it was ‘very rare’ that a business within LVMH submitted a forecast lower than the year before, adding that it was ‘growth, growth at all costs’,” writes reporter Adrienne Klasa. The comments on this story are also very much worth a read. (Financial Times)

The FT story mentions that Alexandre is now responsible for the private sales business, which LVMH short seller Intern Pierre says puts him in a “difficult position”. Can Alexandre and his team sell ten bottles of Dom Pérignon Rosé by David Lynch for €10,000 each? How about Moët Chandon Dom Pérignon Charles & Diana 1961, bottled for Prince Charles’ wedding to Princess Diana, yours for €3,600 a bottle? “Like most other LVMH products these days I genuinely have no idea who is purchasing any of this stuff outside of rappers, athletes with no taste, crypto bros or those guys who rent their ‘penthouse’ and Lamborghini, live in Miami and sell courses”, writes our favourite financial analyst intern. (Intern Pierre)

Watch out for the anti-money laundering rules changes in UK

As of tomorrow, anti-money laundering guidance in the UK will be significantly tightened to potentially include many more traders and dealers of “high-value” products. You may not have noticed, because the change is hidden in almost impenetrable documents on the UK government’s website, but if you or the company you work for deal with high-value luxury products, you’ll want to pay attention to the changes.

The specific change which affects the luxury industry is the addition of “high value dealers” to the list of relevant firms which must now carry out due diligence on their customers. Those dealers will, from tomorrow, be obligated to report any incidents where they know or suspect one of their clients has committed breaches of money laundering laws.

We spoke to Darragh O’Sullivan, the founder of escrow agent Dospay, which helps organisations comply with the UK’s broadening rules around anti-money laundering and combating the financing of terrorism.

“At the moment, anyone who deals with [large amounts of] physical cash you’re required to get ID and to know your client. That was designed to stop money laundering back in the day. What’s changing about the regulations is it’s going to be no longer just about cash. If you are selling anything for more than €10,000, then you need to know who you are selling to”, said O’Sullivan.

“The requirement is that the seller knows who they are dealing with, and can therefore check if they are sanctioned or on a watch list or anything like that”, he said. Lawyers, accountants, banks and financial institutions have had to do this kind of work for a long time, but now O’Sullivan says more people and firms who provide professional services but not necessarily as one of “the professions” will have to do this work too.

Larger firms selling high-value luxury goods are likely to find this additional workload easier, since they will have customer relationship management tools and are likely to already know who their customer is. “A lot of them are already using this kind of client tracking, but in the background, their back office function is going to have to keep an eye on these clients”, said O’Sullivan.

The risk for smaller firms is that they ignore this rule change, and then they are made an example of by the police or investigators. O’Sullivan says a similar analogy is the introduction of the Bribery Act 2010. “What we saw was one really high profile interior designer doing backhanders”, he said. “It was widely acknowledged at the time that all interior designers did this, but when [the case] came in, they really did make an example of this particular organisation who weren’t the big fish… they made a huge deal about it, I think to show that they were serious”, he said.

A big driver of the increased scrutiny of money laundering in the UK has been the expansion of the Office of Financial Sanctions Implementation after Russia’s invasion of Ukraine. “I think when Russia first invaded Ukraine, it was something like seven people working in the sanctions part of the Treasury. There’s something like 200 now”, said O’Sullivan.

‘I forgive you’, says Kim Kardashian to jewellery robbers

Reality TV star Kim Kardashian said she forgives the masked gunmen who stole $10 million worth of jewellery from her and held a gun to head in a luxury hotel in Paris in 2016. One of the accused, Yunice Abbas, 71, claimed that at the time he did not know who they were robbing. Kardashian has become an advocate for criminal justice reform in the US, and has previously travelled (by private jet, of course) to visit prisoners on her show. Most of the jewels were never recovered, except for one diamond-encrusted cross which was found by a passerby the next morning.

The ‘no-name’ hotel where Kardashian was staying

The New York Times has also written a fascinating history of the “no-name” hotel, Hôtel de Pourtalès, where Kardashian was staying, and which has accommodated Prince, Madonna, Usher, Leonardo DiCaprio, and football player Zlatan Ibrahimovic. Outfitted with nine apartments with custom furniture by high-end designers, concierge services, a private chef and personal shopper, it’s reportedly more like a private club than a hotel. “It attracts those less concerned with price than finessing a balance between an overexposed public life and privacy”, writes Tina Isaac-Goizé, adding, “what it did not have, apparently, was spectacular security”. (New York Times)

Break-in blamed for the closure of Luxe Collective

Luxe Collective, a pre-owned luxury retailer which was the launch partner for TikTok’s pre-owned luxury category and which raised £100,000 on the BBC’s Dragons’ Den, will cease trading after seven years. Its co-founder Ben Gallagher blamed the consequences of a warehouse burglary last year where £500,000 of products were stolen, about half of the retailer’s stock. Gallagher said, in a LinkedIn post, that this “ultimately affected my leadership and strategic decision making”. Dark Luxury has heard a similar, previously unreported case of a break-in on a similar scale, and there are regular reports of thieves stealing hundreds of thousands of pounds worth of luxury goods (and even luxury cheese!) from boutiques and resellers. (LinkedIn)

Ever wondered where seized luxury goods end up if the police manage to recover them? John Pye Auctions in Nottingham specialises in selling watches, clothes and jewellery that were bought with the profits of crime. They currently have at least 10 Rolex watches including a £28,300 Rolex Day-Date. (The Sun)

What did Diageo know about Diddy?

The trial of Sean “Diddy” Combs started last week, and his former girlfriend Casandra “Cassie” Ventura has been testifying in the last few days. Combs, who faces federal charges of racketeering, sex trafficking and transportation, is alleged to have used his various business enterprises to facilitate these crimes. Combs Wine and Spirits LLC is among those enterprises, and was the business entity which facilitated Diddy’s 15-year partnership with drinks giant Diageo for 15 years up to 2024, and which collaborated with him on the promotion of Cîroc vodka and DeLeón tequila.

The bulk of Diddy’s estimated $1 billion wealth is said to have come from the unprecedented equal profit-share deal he made with Diageo in 2007 over Cîroc vodka, and it was only in January last year that Diageo paid Diddy $223 million to purchase his 50 per cent share of DeLeon Holdco LLC that it did not own, after Diddy sued over a breach of contract related to their joint venture in DeLeón tequila.

We’re intrigued to know what, if anything, Diageo execs knew about Diddy’s alleged behaviour. The indictment specifically references his “alcoholic spirits business” as part of how Diddy is alleged to have carried out those crimes. And there are photographs of Cassie at a dozen Diageo/Cîroc sponsored events between 2009 and 2017 on Getty in locations including Beverly Hills, Atlanta, Los Angeles, New York City and elsewhere. We’ll be keeping an eye out for any mentions of this business relationship in the trial. (The Guardian)

Trump’s flying palace flies into trouble

Donald Trump has double, nay, tripled down on his plans to accept the Qatari Royal Family’s gift of a Boeing 747-8i to replace the old model, ethics be damned! We can’t get enough of this story at Dark Luxury, and we’ve been devouring all the stories related to it that we can get our hands on. Did you know that the Qataris gave one to Turkish President Erdoğan in 2018? Or that the US Air Force will have to tear the thing apart “down to the studs” to meet the security requirements, which could cost $1 billion? Or that the specs and layout of the aircraft are all over the internet? Or that Business Jet Traveler described the aircraft with its gold furnished interiors as the “best aircraft for potentates”? Or that it’s possible to get the earlier variant, the 747-400, for “well below $10 million” compared to the $400 million that the Qataris wanted?

We also found out that the Qataris used to park a similar aircraft in Bournemouth airport to save on parking fees for years. Local people speculated that it was to pick up a son of the king who used to go to the university there and take him home to Doha. Did you know the Qataris have a fleet of seven aircraft like this, including a private, military spec Boeing C-17 in the Qatar Airways livery?

More Dark Luxury links

The Chinese elite’s favourite car brand, which chauffeured generations of China’s leaders and sells internal combustion powered cars for as much as $1 million, is getting a modern makeover. Imagine Rolls-Royce started selling an electric vehicle for £15,000, and you get some idea of how radical this shift is in China’s fast-moving car industry. (Jing Daily)

The owner of a £3 million townhouse in Mayfair has been ordered to fill their luxuriously fitted 80 sq metre basement with concrete after it was deemed an unlawful development. The Planning Inspectorate said the owner must “restore” the grade II listed building which will mean pouring tonnes of concrete into a space that currently has a gym, sauna and cinema room. “I hope this outcome sends a clear message: those who ignore planning rules will be held accountable,” said Geoff Barraclough, Westminster city council cabinet member for planning and economic development. (The Times)

De Beers, the world’s biggest miner and seller of diamonds, has been quietly selling rough diamonds at a huge discount. (Bloomberg News)

Did you find this newsletter useful or interesting? Please forward it to a friend or colleague, or share your thoughts with us on Bluesky or on Instagram.