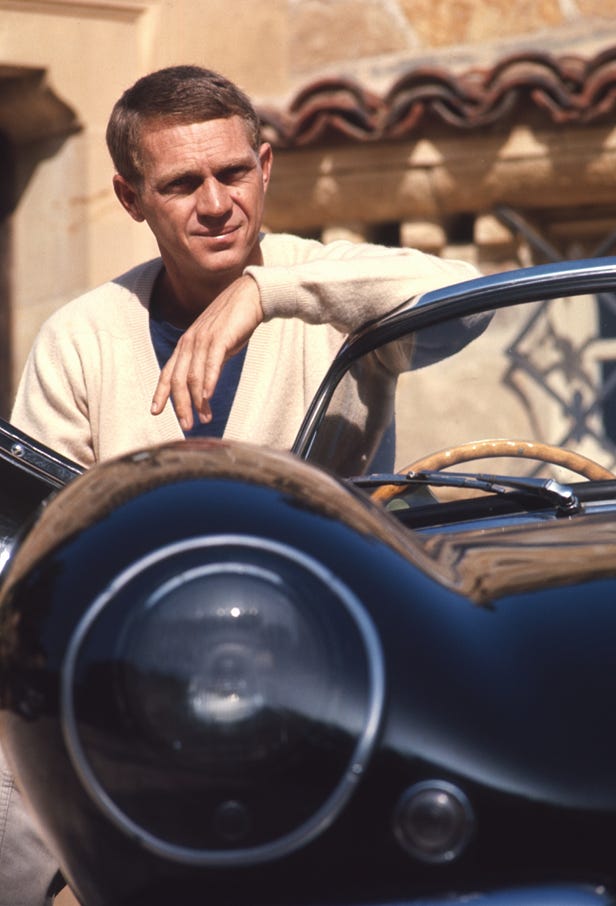

Jaguar’s £15 billion gamble: from Steve McQueen’s sportscars to 'Copy Nothing'

Jaguar second-hand US car value data seen exclusively by Dark Luxury reveals the scale of the challenge facing British marquee as it pursues an 'all-in' rebrand

There are few things more exciting than putting your foot to the floor in a priceless 1950s sports car. I can still hear the howl of the Jaguar XK120’s flat six 3.5 litre engine today, even though my experience was over ten years ago, and my time with the car was only a few hours long.

That, plus the smell of the red leather trim, the huge wooden steering wheel and the open top with no safety roll-bar allowed me to experience something of the thrill that former XK120 owners Clark Gable and Humphrey Bogart might have felt driving the-then fastest production car in the world around Hollywood.

As an editor at GQ, I was invited to drive the Jaguar XK120 at Goodwood Revival by Jaguar, where I also pootled around in the Queen Mother’s claret Mark VII which she owned from 1955 to 1973. These two models represent the start of Americans’ long love affair with the brand. Like Tesla, Jaguar made an exciting and impractical sportscar to capture the imagination of Americans, then made a high-performance luxury saloon and sold that in larger numbers. Both cars at Goodwood were looked after by the Jaguar Heritage Trust, a charity that aims to “preserve the rich legacy of Jaguar Cars Ltd”, a legacy Jaguar is now throwing in the bin.

The British carmaker, now owned by India’s Tata Motors, is gambling £15 billion on one of the automotive industry's most audacious transformations. It intends to abandon its entire customer base, double prices to over £100,000 and target ultra-luxury buyers with an all-electric lineup. It has already entirely stopped making cars, so sales have dropped to zero — appropriately, since the concept car that represents its new vision is called the Type 00.

The next five years will determine whether Jaguar's transformation represents visionary leadership or expensive delusion. The company's willingness to risk everything on reinvention might resonate with luxury buyers seeking alternatives. This kind of thing is not uncommon in luxury fashion, after all. Just look at Virgil Abloh at Louis Vuitton who blended the brand with streetwear and took the brand in a more diverse and inclusive direction, or Demna at Balenciaga who used shock value and sold $2,000 Ikea bags and similary overpriced distressed trainers. A more worrying and relevant analogy might be Burberry, which went edgy and later regretted it.

Jaguar’s rebrand could determine the fate of one of Britain's most iconic brands. Some very interesting proprietary data we’ve seen suggests that Jaguar has an uphill task at completing a successful, luxury fashion-style reinvention, even with £15 billion in funding and several years to do it.