Pinault's all-or-nothing Gucci gamble

Kering boss rumoured to be giving up CEO role as Gucci adopts see-now, buy-now strategy for Gvasalia collection. Plus, Menswear Guy vs the Vice President, and AI marches into luxury

Kering CEO and Chairman François-Henri Pinault is reportedly planning to take a step back from his chief executive role, according to business magazine Challenges and a source in the recruiting industry who told Dark Luxury they had heard the same. According to Challenges, French headhunting firm Jouve & Associés has been employed to find potential CEO hires, while Pinault is expected to retain the chairman role and control over long-term strategic vision.

Both internal and external candidates are being considered for CEO. Current deputy chief executive officers Francesca Bellettini and Jean-Marc Duplaix are in the running, and Kering will also consider candidates from outside of the luxury goods industry.

The prospect of Pinault relinquishing the top operational job comes amid reports that the company is preparing to make a big bet that its new Gucci line will be an instant hit. The debut line from new Gucci creative director Demna Gvasalia will roll out on a see-now, buy-now strategy, reports Italy’s Fashion Magazine. Instead of the usual six month wait before it goes on sale to retail customers, his first collection will be available immediately in 50 stores worldwide after its debut in September.

You only have to go back to 2016 to find quotes from Pinault saying such a tactic “negates the dream” of luxury, while a six month wait “creates desire”. At the time he was mulling over a similar see-now, buy-now approach but then Kering was riding high on Alessandro Michele’s dazzling first collection for Gucci, which sold so well that there was no need for any markdowns.

According to the report, Gucci CEO Stefano Cantino and Kering Deputy Bellettini want to see immediately whether the new-look Gucci is a commercial hit. The hope is that Demna’s hardcore fans, who they believe are hotly anticipating this collection, will build broader hype and momentum (presumably before online critics get a chance to savage it as they did with Sabato De Sarno’s debut). The show will also incorporate some kind of conceptual digital spectacle to coordinate with the store roll out.

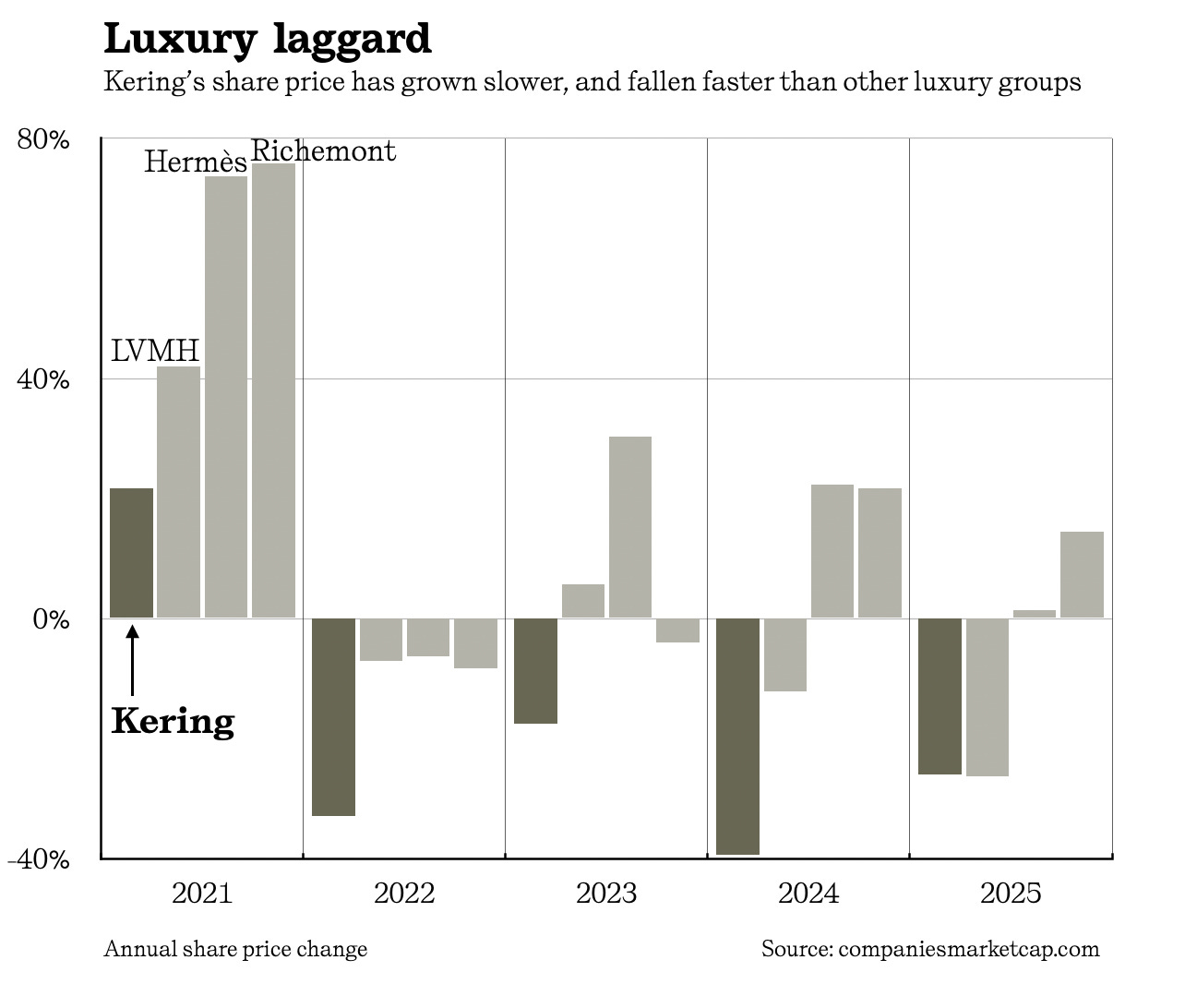

The need to take a gamble on Gucci’s new line is inextricably linked to the reasons a shakeup at the top has started to look inevitable. Rising debt and declining sales, the latter driven largely by problems at Gucci, are threatening the company’s share price and the Pinault family’s control of the group.

Debt at Kering has increased from €2.8 billion in 2019 to €10.5 billion in 2024. The Pinault family, which controls Kering through the holding company Artemis, has also run up debts from €3.5 billion in 2022 to over €6 billion in 2023, partly to fund the acquisition of Creative Artists Agency for an estimated $7 billion.

That rise in debt has coincided with Sabato De Sarno’s disastrous period as creative director for Gucci, the most important brand within the group. Gucci has suffered one of the worst falls in sales ever for any global luxury brand. Its Q1 2025 sales were just €1.57bn, a 25 per cent fall year on year. If those numbers continue throughout the rest of the year, 2025 revenue would hit just €6.3bn, down 40 per cent from €10.4 billion in 2022.

Now read:

Gucci’s failure to recover means the group needs cash and quickly if the Pinault family is to maintain control. That’s why it’s reportedly in talks with buyout group Ardian to sell its stake in the prestigious Saks 5th Avenue building it bought last year. Kering also hopes to raise €2 billion from sales of additional prime retail locations in Milan and Tokyo.

If Gucci’s hoped-for turnaround fails to materialise, this could weaken the family’s control via the entry of new shareholders such as, potentially, the Qatari-owned Mayhoola fund, which holds 70 per cent of Valentino, according to a report by analysts at Bernstein. If Kering wants to complete its acquisition of Valentino, which would cost around €4 billion, it might offer shares to Mayhoola instead of cash. By comparison, the families that control rivals LVMH and Hermès are in rock solid and well defended positions, relatively free of debt, Bernstein’s analysis said.

What’s so fascinating about luxury fashion is that it might only take one brilliant collection to make everything OK again. It’s happened twice in Gucci’s hugely dramatic history. Tom Ford’s plush, Studio 54 velvet and silk revival in 1995 not only turned around sales but also paved the way for it to go public, and pretty much single-handedly helped to create a big part of the Kering group as we know it today. Alessandro Michele’s inspired baroque-thrift romanticism helped boost the share price from €155 in 2015 to €538 in 2022. Almost all the problems within Kering stem from the mismanagement of his replacement. At the heart of this story is the power of creativity.

Of course, the problem is made even worse by other underperforming brands in the group such as Balenciaga, which is yet to recover from an advertising campaign savaged for using paedophilic imagery. And guess who was responsible for that? Yes, that’s right, Demna Gvasalia, the new creative director of Gucci, and arguably, the most influential designer of his generation.

The stakes are huge: one clever appointment and one good collection is all it takes to turn the whole thing around. If not, the doom spiral continues. See-now, buy-now? Let’s see in September. (Fashion Magazine)

In this week’s newsletter

In the rest of this week's newsletter for paid subscribers…

You've read:

Pinault's all-or-nothing Gucci gamble

Paid subscribers get the rest:

How one high-end French retailer is deploying AI for VVIP clients

What Chanel's move into recycling is really about

Menswear Guy vs the Vice President of the United States and more…