The mafia investigator ruffling Italy's luxury industry

'Paper sings', says Milan prosecutor Paolo Storari. Plus: A bumper selection of analysis and luxury news from over the Christmas break

Dark Luxury’s hero of 2025, and the luxury industry’s biggest villain?

The man in the photo is Milan prosecutor Paolo Storari, who has led investigations resulting in exposés of labour abuses in the supply chains of several luxury firms in the last few years. He should be the industry’s hero for helping bring horrific examples of labour exploitation to light so that the issues may be rectified. And yet, Storari has been criticised by figures including luxury loafer maker Tod’s founder and chair Diego Della Valle, who said Storari “should be ashamed” of his work in October.

Thanks to Storari’s work and the work of his office, we know about many cases of workers for subcontractors making bags and clothes for brands including Dior and Armani, some of whom were living and sleeping in the workplace in order to make their extraordinarily expensive items. One Chinese worker was forced to work 13 hours a day, seven days a week making items in a factory which supplied Loro Piana, and who was beaten so badly he had to stay in hospital for two months.

In early December, Italian police carried out inspections at the headquarters of 13 high-end fashion companies, seeking internal documents on governance and supply-chain controls, suggesting Storari’s work still has a long way to run.

Della Valle’s comments came before the Milan prosecutor’s office upped the stakes significantly in late November, alleging that Tod’s itself and three managers “were fully aware of and complicit in labour exploitation”. Until then, the investigations had been limited to the Chinese-owned workshops which supplied the luxury brands, and those brands had not been directly targeted by criminal probes, although several have been put under temporary court administration and paid fines. The office also requested that the court impose an advertising ban on Tod’s, and a court decision on that has since been delayed until February.

Tod’s said it had already cut off its relationship with the four subcontractors who are being investigated. “We would like to reiterate that our group is often considered a model of conduct and has always given the utmost consideration to the health and quality of life of its employees”, the company said in a statement at the time.

The FT’s Elizabeth Paton and Silvia Sciorilli Borrelli’s article about the reaction to all of this over the Christmas break explains how Storari has “turned a fringe issue into a national scandal”, potentially threatening the sanctity of the Made in Italy merchandise mark. Speaking at a Milan conference, he addressed the industry’s concerns that he’s gone overboard, saying “carta canta”, which literally means “paper sings”, or less poetically, facts are facts.

Storari has been investigating high fashion for a decade now, starting with a 2016 case looking at links between Milan’s Fiera Milano trade fair complex and the Calabrian and Sicilian mafia. In 2017, he prosecuted the Polish gangster who abducted British model Chloe Ayling in Milan. He has a formidable reputation tackling drug trafficking, election rigging and financial crimes linked to the ‘Ndrangheta, as well as the mafia’s infiltration of hardcore Italian football supporter groups. Storari is unlikely to stop his investigations until the industry can prove that it has cleaned up its supply chain.

In the rest of this Dark Luxury newsletter

The Hermès family is now the world’s fifth richest

A hedge fund for Birkins returns 40 per cent

NFI: the inexorable decline of fashion magazines

A quick look at Venezuelan luxury loot

Shifts in Hermès and LVMH family offices

The Hermès family is the fifth richest in the world according to the latest Bloomberg ranking, with a total net worth of $184.5 billion, up nearly $15 billion from last year. Part of the reason their wealth continues to grow might be down to their choice to increasingly diversify away from luxury. Krefeld, the family office which controls their fortune, launched a new investment arm called Breithorn Holding to do just that last year.

Chanel’s owners, the Wertheimers, are still at number nine on the list, but their total net worth is down $2 billion from last year. Last year, Arthur Heilbronn, a 38-year-old half brother of Chanel heirs Alain and Gerard Wertheimer quietly took on a more prominent role overseeing their sprawling investments through Mousse Partners, the discreet family office that manages the Chanel fortune. (Bloomberg News)

The Arnault family appears to be almost single-handedly holding up the Paris luxury home market. (FT)

The rise and rise of luxury discounting

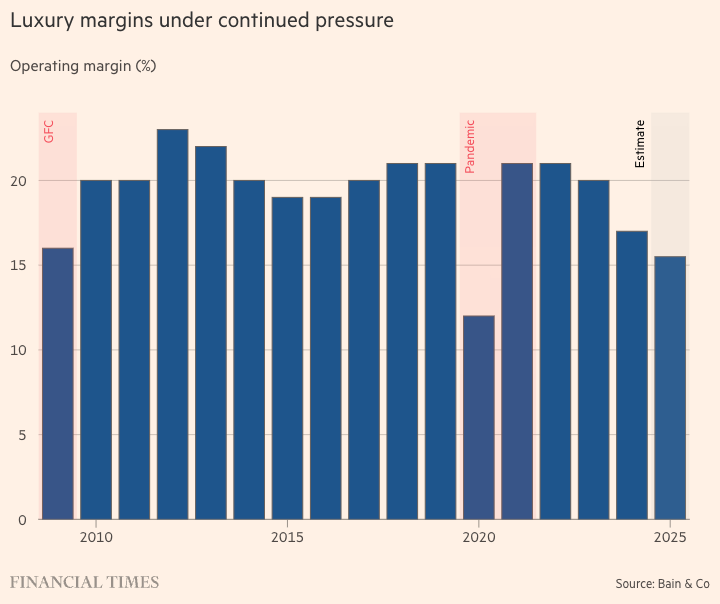

About 35 to 40 per cent of luxury goods were sold at a discount last year according to research by Bain and Italian luxury goods association Altagamma, a five percentage point increase on the level ten years ago. Luxury margins are under pressure amid stalling creativity at the major fashion houses, declining quality, skyrocketing prices since the pandemic and a decline in sales from China. That’s illustrated by this chart which shows the decline in margins for luxury firms, back to levels not seen since 2009, if you exclude the one-off pandemic hit. (FT)

The inside story of Louis Vuitton’s ‘ship to nowhere’

“We are totally crazy, aren’t we?”, said LVMH boss Bernard Arnault to Louis Vuitton CEO Pietro Beccari at the opening of a new store in Shanghai , which is shaped like a giant “ship that never sails”. (WSJ)

A hedge fund for Birkins

Asset manager Luxus, which describes itself as “Luxury Alternative Asset Management”, buys secondhand Birkins and Kelly bags on the secondary market in order to flip them for a profit, and it claims to have achieved a 40 per cent return in its first year after raising $1 million to buy 36 bags. You can even shop their “portfolio” online via retailer My Gemma. Bloomberg Opinion’s Allison Schrager explains why investing this way might not be such a great idea, although betting on Birkins perhaps isn’t such a bad idea if you had to pick a luxury asset. (Bloomberg News)

Luxury handbags may be shoddier than you think, reports the Economist, which looks at the rapidly hiking prices of cowhide bags despite questionable quality. It draws a sharp contrast with Hermès, which uses a single artisan to make its Birkin bags. (Economist)

From the archive: If you do decide to invest in Birkins, don’t stray too far from the tried and tested classics…

Blue chip Birkins

Our interview with a woman who manages a multi-million pound portfolio of Chanel, Hermès and Louis Vuitton handbags...

How Russians get sanctioned luxury goods

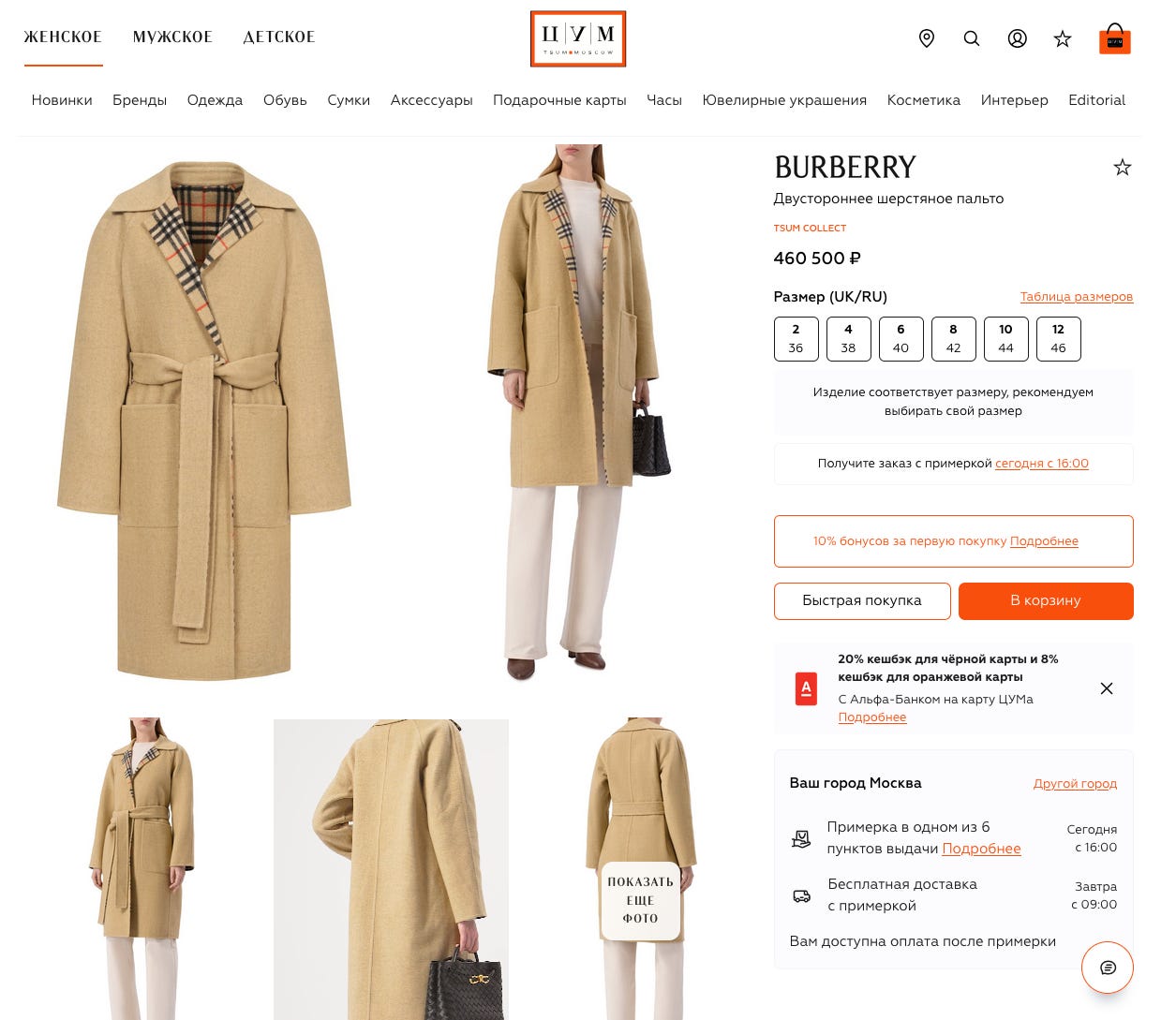

Russian shoppers are paying double for luxury goods from Europe. “This is something of an open secret,” said one unnamed luxury chief executive in Milan, speaking to the FT. The story is about Russian retailer Tsum in Moscow, which says “The tsum.ru website is accessible only within the Russian Federation”, but it’s not hard to get around it.

Above is a screenshot of a Burberry wool coat selling for 460,000 Russian roubles, (£4,181.65), a more than 55 per cent markup on the price in the UK. The EU banned exporting goods to Russia with a wholesale price of more than €300 in 2022, but large volumes are sold to buyers in Turkey, UAE and China and then re-exported. The arbitrage opportunities are obvious. (FT)

In the rest of this newsletter… for paid subscribers

Another 2,000 words of fascinating links and analysis on:

The decline of fashion magazines

LVMH vs Morgan Stanley

The Bolibourgeoisie’s luxury loot

How big is the illegal trade in falcons?

The letter of the year is K(-shaped economy)