Bernard Arnault bought the dip

Power consolidation at LVMH, corporate triage at Kering and the strange winner of the UK's biggest cyberattack.

In this week’s Dark Luxury news round-up

The latest power plays at LVMH and Kering

The surprise winner of the Jaguar Land Rover cyberattack

The definitive guide for how to pronounce Hermès

Was the Louvre heist an inside job?

Vogue Business folds into Vogue.com

The great luxury game

While traders fretted about the slowdown in luxury sales, selling up and driving down the share price of Bernard Arnault’s LVMH empire, he was playing chess. (Not literally.) Between February and October 2025, as LVMH shares took a hit from weaker earnings, Arnault snapped up €1.4 billion worth of the company’s stock. This strategic buying spree, executed through family holding companies, allowed him to tighten his grip on the luxury behemoth he founded nearly four decades ago, all at a healthy discount. The LVMH share price is up more than 25 per cent in the last six months. (Bloomberg)

The company has made a substantial investment to develop the legendary Orient Express brand. The firm reportedly invested €131 million to buy half of the equity from hospitality company Accor, gaining stakes in its hotels, trains and cruise ventures. L’Informé revealed the full structure of this complex deal, which expands into ultra-luxury travel with €7,000 train journeys, €1,280-a-night hotels and €316,000 cruises, with LVMH holding an option for full control in 2027. (L’Informé)

As Arnault fortifies his empire, his firm’s chief rival, Kering, continues its shake-up. The group’s new CEO, Luca de Meo, has brought in consultants from Bain and BCG to conduct a thorough review of the company’s portfolio of brands. (La Lettre). There is speculation that a sale of Alexander McQueen could be on the cards, reports Lauren Sherman at Puck, who says the brand’s London headquarters are likely to see a 20 per cent reduction in staff. (Notably, McQueen was one of the few brands de Meo mentioned in a Vogue Business profile we mentioned in our previous round-up, so the brand is obviously on his mind.) (Puck News).

The question of who will take over continues to hang heavy in the air at Armani. Puck’s Sherman says LVMH looks less and less likely, but Ferrari, eyewear giant EssilorLuxottica and beauty behemoth L’Oréal are all seen as potential buyers. (Puck News)

Hermès appointed Grace Wales Bonner, 35, as creative director of men’s ready-to-wear last week, and she’ll debut her first collection for the French house in January 2027. Known for her Adidas collaborations and, in China, a strong Gen Z following on Xiaohongshu (China’s answer to Instagram), the move is about targeting China’s young luxury consumers, writes Jing Daily’s Sadie Bargeron. (Jing Daily)

Speaking of Hermés, “My father used to say that if you want to pronounce Hermès correctly, think of a traffic jam in the air,” says Pierre-Alexis Dumas in this Wall Street Journal profile. “Air mess.” (WSJ)

Vogue Business, Condé Nast’s much-hyped rival to Business of Fashion and WWD, is being rather unceremoniously folded into Vogue.com after just six years. The venture, which charged a hefty subscription fee is a cautionary tale for those who try to build a business on the fickle whims of the fashion world, says Marcus Jaye, aka The Chic Geek. Don’t we know it. (The Chic Geek)

Cyberattack winners and losers

The recent cyberattack on Jaguar Land Rover is the costliest in UK history according to researchers at the Cyber Monitoring Centre. The hack, which paralysed the carmaker’s operations for five weeks, is projected to cost a jaw-dropping £1.9 billion. The attack sent shockwaves through the entire supply chain, affecting an estimated 5,000 businesses, and almost certainly affecting UK GDP figures. The full recovery is not expected until January 2026. (BBC News)

The production halt had an immediate and dramatic impact on the UK’s manufacturing output. In September, car production plummeted by 27.1 per cent, while commercial vehicle production nosedived by a staggering 77.1 per cent. The combined effect was a 35.9 per cent drop in total vehicle production across the whole country, a clear illustration of the immense disruption caused by the attack. (Top Gear)

In a bizarre twist of fate, the production shutdown at JLR created an unexpected opening for Aston Martin. With fewer British-made cars being shipped to the US, Aston was able to export its vehicles at a lower 10 per cent tariff rate, avoiding the steeper 27.5 per cent tariff that kicks in after a certain quota is met. It was a rare piece of good news for the struggling luxury carmaker, which has been grappling with widening losses – you’ll remember last week that crazy stat, that financial results analysed by the FT suggest that every car sold since 2014 has cost the company about £45,000! (FT, WSJ)

While European carmakers are licking their wounds, their Chinese counterparts are celebrating a major victory. In September, Chinese car brands achieved their best-ever month of sales in Europe, capturing a record 7.4 per cent of the market, led by BYD, SAIC’s MG brand and Chery. It’s a watershed moment that signals a dramatic shift in the continent’s automotive landscape. (Bloomberg) The road ahead is not without its bumps for Chinese EV makers. Nio, once a darling of the premium EV market, is reportedly losing its charge, a reminder of the intense competition and volatility in the electric vehicle space. (FT)

The investigation into the audacious jewel heist at the Louvre has taken a tantalising turn, with detectives now working on the theory that it was an inside job. (The Telegraph). Five more suspects have been arrested since our story last week, bringing the total to seven, yet the priceless royal gems remain missing. (FT)

A multi-million euro art forgery ring has been dismantled in Germany, with the main suspect a 77-year-old German man. The operation, which spanned Germany, Switzerland and Liechtenstein, reportedly involved the elderly gentleman peddling a remarkable collection of fake Picasso, Rembrandt and Frida Kahlo works. (BBC News)

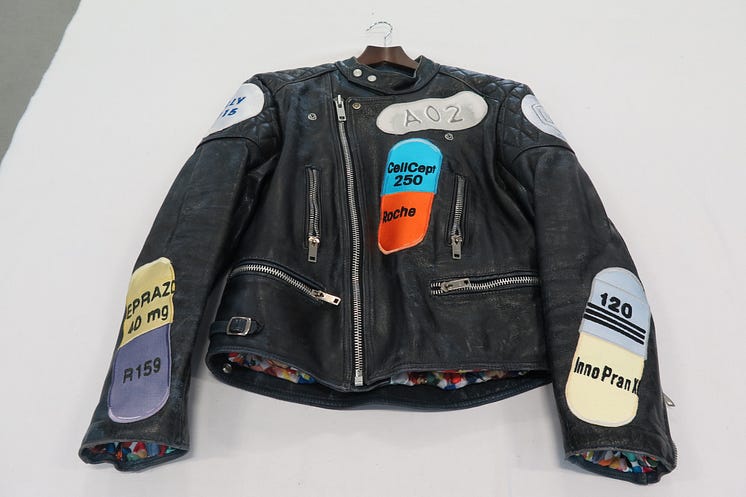

In London, a father and son have been sentenced for what seems like a remarkably specific theft. Liam Middleton-Gomm received a two year and eight month prison sentence for stealing Damien Hirst–designed jackets from a Hammersmith studio. His father, Leslie, who had photos of the stolen items and searched “Damien Hirst” and “leather jackets” online, received a conditional discharge for handling stolen goods. (Met Police)

Also in London, a family is seeking a private tutor for their one-year-old child, with a salary of £180,000 per year. The goal? To immerse the toddler in “quintessentially British experiences to help hone his habits, outlooks, tastes and sporting preferences”, and secure a place at a top public school like Eton or Harrow. The race to the top begins in the cradle. (Guardian)

In Japan, the country’s new Prime Minister, Sanae Takaichi, has catapulted Hamano Inc., a 145-year-old leather goods manufacturer into social media feeds in the country. The viral attention has led to a flood of orders: everyone’s an influencer these days, even PMs. (Bloomberg)

Two-thirds of Britons earning over £100,000 believe they are going to heaven, according to a survey by More in Common, while middle earners are the most likely to think they are destined for hell. Camel, meet the eye of the needle. (Twitter)

Did you find this newsletter useful? Please forward it to a friend or colleague, or share your thoughts with us on Bluesky or on Instagram.

Fear ANY CEO who bring in “Management Consultants”! It indicates that the CEO doesn’t have any strategy OR sector expertise. Remember Nike’s just departed/kicked out CEO who relied heavily upon management consultants….. and how disastrous that turned out to be!

That’s a ridiculously long prison sentence for stealing some jackets?! And that ad, I cannot. 🫣🫣